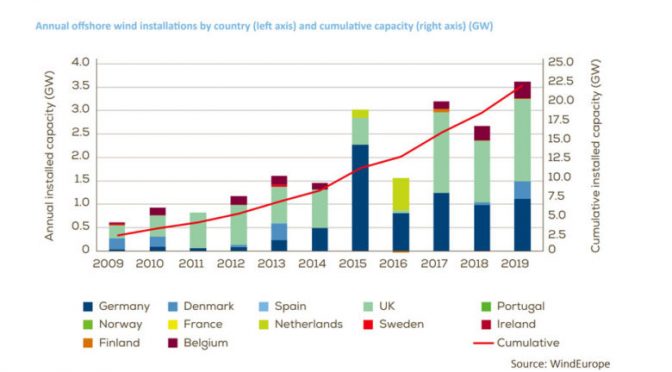

Europe installed 3.6 GW of new offshore wind capacity in 2019, according to statistics released by WindEurope. This is a new record in annual installations.

10 new offshore wind farms came online across 5 countries. The UK accounted for nearly half of the new capacity with 1.7 GW. Then came Germany (1.1 GW), Denmark (374 MW) and Belgium (370 MW). And Portugal installed 8 MW of floating offshore wind. Europe now has 22 GW of offshore wind. The UK and Germany account for three-quarters of it. Denmark, Belgium and the Netherlands share nearly all of the rest.

The average size of the offshore turbines installed last year was 7.8 MW. A 12 MW offshore wind turbine was installed in Rotterdam. Offshore wind farms are also getting bigger. The average size doubled – it was 300 MW in 2010. Now it is over 600 MW. The largest is Hornsea 1 in the UK – 1.2 GW.

The launch of the new Portuguese floating project – WindFloat Atlantic, funded by the EU’s NER300 programme, means Europe now has 45 MW of floating offshore wind. France, the UK, Norway and Portugal are all developing new floating projects. France plans to auction a large-scale floating wind farm in 2021.

Offshore wind costs continue to fall significantly. Last year’s auctions – in the UK, France and the Netherlands – delivered prices for consumers in the range of EUR 40-50/MWh. This is cheaper than building new gas, coal or nuclear.

2019 also saw investment decisions in 4 new offshore wind farms, representing 1.4 GW in capacity and EUR 6bn in investments.

The European Commission says Europe needs between 230 and 450 GW of offshore wind by 2050 to decarbonise the energy system and deliver the Green Deal. This requires Europe to build 7 GW of new offshore wind a year by 2030 and ramp up to 18 GW a year by 2050. But the current level of new installations and investments is a long way behind that.

“Europe really embraced offshore wind in 2019. Auction prices showed it’s now cheaper to build offshore wind than new gas or coal plants. Several Governments raised the amount they want to build. This time last year we were looking at 76 GW by 2030. Now it’s 100 GW,” WindEurope CEO Giles Dickson said.

“But we’re not currently building enough to deliver on that, let alone the more ambitious volumes needed to deliver the Green Deal. The EU Commission says we need up to 450 GW of offshore by 2050. That means 7 GW new offshore wind every year by 2030 and 18 GW by 2050. Last year we built a record amount, but only 3 GW.”

“The bigger numbers are doable and affordable. The new EU Offshore Wind Strategy in the Green Deal should map out clearly how to mobilise the investments needed for 450 GW. Crucially it should provide a masterplan (a) to develop the offshore and onshore grid connections and (b) to get the maritime spatial planning right. This will require ever closer cooperation between Governments in the North Sea and the Baltic. And this should also include the UK – they were half of Europe’s investment in offshore wind in the last decade and will remain by far the biggest market.”

Figures and data

WindEurope report summarises construction and financing activity in European offshore wind farms from 1 January to 31 December 2019.

WindEurope regularly surveys the industry to determine the level of installations of foundations and turbines, and the subsequent dispatch of first power to the grid. The data includes demonstration sites and factors in decommissioning where it has occurred. Annual installations are expressed in gross figures while cumulative capacity represents net installations per site and country.

Europe added 3,623 MW net offshore capacity in 2019. This corresponds to 502 new offshore wind turbines connected to the grid, across 10 wind farms. Europe now has a total installed offshore wind capacity of 22,072 MW. This corresponds to 5,047 grid-connected wind turbines across 12 countries.

Installations in 2019

- Europe added 3,627 MW of new (gross) capacity. The UK (1,764 MW), Germany (1,111 MW), Denmark (374 MW), Belgium (370 MW) and Portugal (8 MW) supplied this new capacity to the grid.

- A net addition of 502 grid-connected offshore wind turbines across 10 wind farms were added from 1 January to 31 December 2019.

- 7 wind farms were completed (fully grid-connected). Another 3 have partial grid connection and will continue to connect turbines in 2020. Construction work started on 5 other wind farms where no turbines have yet been grid-connected.

- Siemens Gamesa Renewable Energy account for 62% of the turbines connected to the grid. MHI Vestas Offshore Wind connected 28% and supplied turbines to five countries.

- 2 turbines (2 MW each) were decommissioned at the Blyth Demonstrator in the UK.

Cumulative installations

- The installation and grid-connection of 5,047 turbines represents a cumulative 22,072 MW.

- There are now 110 offshore wind farms in 12 European countries (including sites with partial gridconnected turbines).

- The UK has the largest amount of offshore wind capacity in Europe, with 45% of all installations. Germany is second with 34%, followed by Denmark (8%), Belgium (7%) and the Netherlands (5%).

- Ørsted (16%), RWE (12%), Vattenfall (7%) and Macquarie (7%) are the largest owners of offshore wind farms.

Trends: turbine and wind farm size, depth, distance from shore, auctions

- The average rated capacity of turbines installed in 2019 was 7.8 MW, 1 MW larger than in 2018.

- The average size of wind farms in construction almost doubled in one decade (621 MW).

- The average distance to shore (59 km) and water depth (33 m) continue to increase even though most wind farms are bottom-fixed.

- All auction results in 2019 ranged between 40-50 EUR/MWh.

- Port of Rotterdam made history by installing the first GE Haliade-X 12 MW prototype.

- The first dynamic cable of 66 kV was installed by JDR for the Windfloat Atlantic.

- Hornsea One built the industry’s first offshore reactive compensation platform.

Financing highlights

- In total 1.4 GW of new capacity reached Financial Investment Decision during 2019 in France, the Netherlands, Norway and the UK. The financing raised for the 4 wind farms was EUR 6.0bn, 40% less than in 2018.

- Refinancing was also lower than in 2019, at EUR 4.2bn, bringing total financing for the sector to EUR 10.2bn.

- Non-recourse debt continues to be significant in offshore wind financing with EUR 8.8bn lent in 2019. This represents the second highest annual amount after the record EUR 16.5bn offered in 2018.

- 2019 saw EUR 7.4bn of project acquisition activity, with 3.9 GW of projects in various stages of development acquiring new owners.

- 83% of acquisition investment was carried out by the financial services sector and two thirds of the acquisitions (by investment amount) was for operational wind farms.